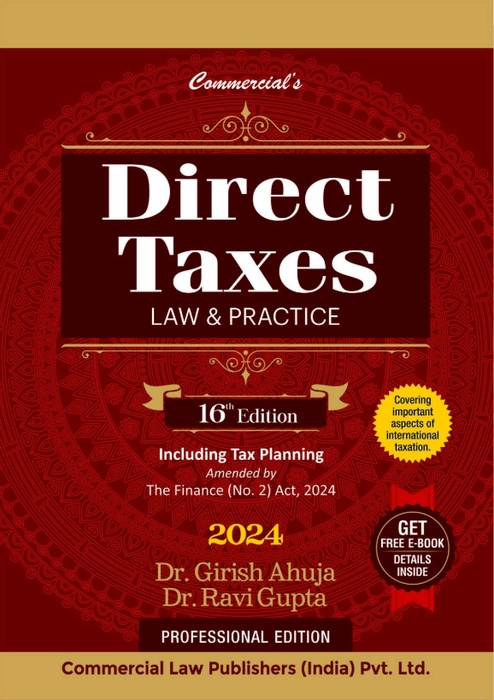

Direct Taxes Law & Practice (DTL) As Amended by Finance (No. 2) Act, 2024 | Dr. Girish Ahuja & Dr. Ravi Gupta | Commercial Law Publishers | 2024 Edition

Product details

This comprehensive and authoritative book provides a detailed exploration of the laws and practices surrounding direct taxes, with a special focus on the latest amendments introduced by the Finance (No. 2) Act, 2024. It is designed to serve as an essential reference for tax professionals, practitioners, and students who want to stay informed about the most recent changes in tax legislation.

Key Features:

- In-Depth Coverage of Direct Tax Laws: A thorough examination of various direct tax laws, including income tax and corporate tax, along with detailed explanations of tax practices.

- Updated with the Latest Amendments: Incorporates the most recent changes brought about by the Finance (No. 2) Act, 2024, ensuring that the reader is well-versed with the latest tax laws.

- Practical and Case-Based Approach: Provides practical insights and case studies to help readers understand complex tax issues and their application in real-world scenarios.

- Comprehensive Resource for Professionals and Students: A vital guide for tax professionals looking for up-to-date tax information as well as students preparing for exams or certifications in tax law.

- Well-Researched Content: The book is written by two renowned experts in the field of taxation, Dr. Girish Ahuja and Dr. Ravi Gupta, known for their clarity and precision in explaining tax concepts.

The Direct Taxes Law & Practice (DTL) As Amended by Finance (No. 2) Act, 2024 is an indispensable resource for anyone looking to deepen their knowledge of direct tax laws, providing a structured and accessible approach to understanding complex tax regulations.

| Title: |

Direct Taxes Law & Practice (DTL) As Amended by Finance (No. 2) Act, 2024 | Dr. Girish Ahuja & Dr. Ravi Gupta | Commercial Law Publishers | 2024 Edition |

| Applicability: | 2024 |

| Author: | Dr. Girish Ahuja & Dr. Ravi Gupta |

| Publisher | Commercial Law Publication |