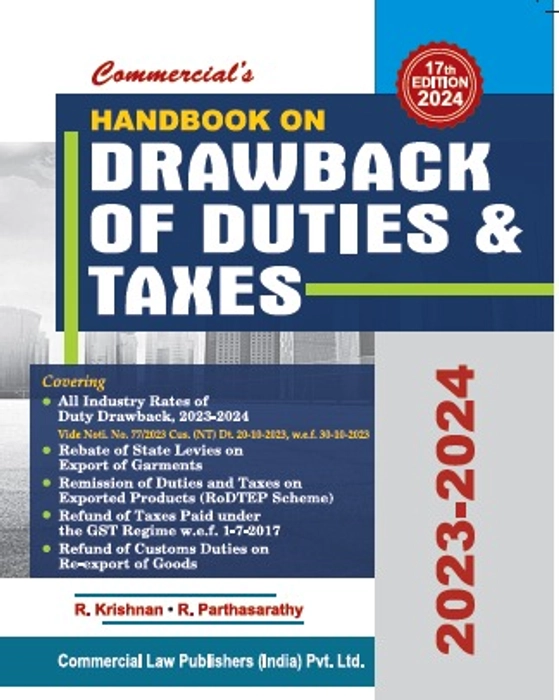

Handbook on Drawback of Duties & Taxes | R Krishnan & R Parthasarathy | Commercial Law Publishers | Applicable For May 2024 Exam

Get 2% Extra Cashback on all orders

You may also like

View AllProduct details

Introducing the ultimate Handbook on Drawback of Duties & Taxes, perfectly designed to help you conquer the challenges of the upcoming May 2024 Exam. This comprehensive guide is an essential resource for students, professionals, and anyone seeking a deep understanding of drawback of duties and taxes.

?? The Handbook covers all the key concepts, principles, and regulations related to drawback of duties and taxes, providing you with a solid foundation for exam success.

?? With clear and concise explanations, this Handbook breaks down complex topics into easily understandable sections, making it easier for you to grasp and retain crucial information.

?? Here are some key highlights of this incredible Handbook:

?? In-depth coverage of drawback scheme: Get a thorough understanding of the drawback scheme, its purpose, advantages, and its role in promoting exports.

?? Various types of drawbacks explained: Explore different types of drawbacks, including All Industry Rate Drawback, Brand Rate Drawback, and Standard Input Output Norms (SION) Drawback, among others.

?? Detailed analysis of legal provisions: Dive into the legal provisions governing the drawback of duties and taxes, including the Customs Act and the Customs Tariff Act, ensuring you have a solid understanding of the regulatory framework.

| Title: |

Handbook on Drawback of Duties & Taxes | Commercial Law Publishers | Applicable For May 2024 Exam |

| Edition | 2023 |

| Author: | Vandana Bangar |

| Publisher | Commercial Law Publications |

Join Whatsapp Group for Latest LAW BOOKS Updates

Join Whatsapp Group for Latest LAW BOOKS Updates